cmstesting domain:

Instant Insight Engine For Market Moves

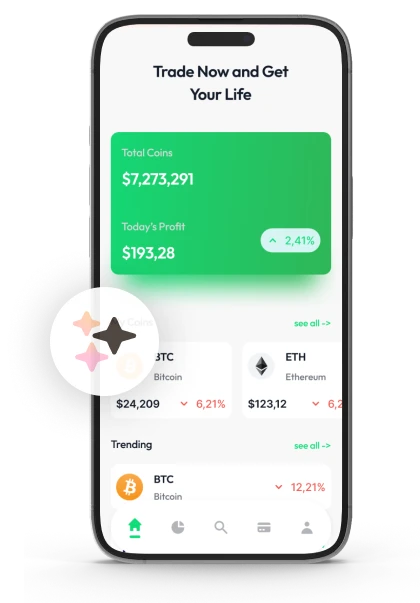

Machine-learning pipelines within Stocks Synergy Ai refine projections after every market close, detecting subtle patterns that often precede reversals. Because cryptocurrency markets are highly volatile and losses may occur, the app presents probability zones -never automated trade execution - so timing and size decisions remain fully controlled by each trader.

Round-the-clock monitoring by Stocks Synergy Ai supports a strategy-sharing library where vetted playbooks sit beside live analytics; newcomers can scale exposure safely while advanced users blend tactics for bespoke portfolios. Encrypted pathways, multi-factor entry, and capped seat availability preserve data integrity and system speed, encouraging early registration before allocation limits are reached at Stocks Synergy Ai.

From pre-market whispers to after-hours spikes, Stocks Synergy Ai canvasses earnings bulletins, macro releases, and price-volume jolts every second. Machine-learning channels refine raw alerts into intuitive colour lanes guiding all proficiency tiers. Layered encryption and multifactor checkpoints protect private data at every hop, while limited enrollment steadfastly preserves app velocity for each registered member, ensuring insight flow worldwide.

Rising momentum seldom shouts its arrival; instead, faint liquidity knots and rotational hints whisper first. Stocks Synergy Ai sweeps thousands of micro-prints per second, converts them into colour signals, and places the digest in plain view so participants of every background can schedule entries while costs remain manageable.

Relative strength, liquidity pulses, and sentiment tides are re-weighted continually. Stocks Synergy Ai compares living data with long-term market archives, reshaping probability arcs as landscapes change. Concise cards outline risk bands, projected ranges, and confidence scores, prompting timely plan reviews before volatility intensifies.

Stocks Synergy Ai hosts a reflection board where certified methodologies sit beside breathing charts, showing when each style excels or falters. Early adopters value this advantage. Seats stay limited, so registering now secures bandwidth for uninterrupted study. Every playbook arrives with scenario maps and sizing calculators. Stocks Synergy Ai never executes; instead, Stocks Synergy Ai supplies objective evidence, leaving execution power strictly with every user.

Privatumo monetas siūlo apsaugą, kai finansiniai duomenys vis labiau pažeidžiami kibernetinių grėsmių ir stebėjimo. Su cmstesting domain prekybininkai gali sužinoti apie privačias monetas ir prekiauti jų vertę.

Kiekvienas, kuris užsiregistruoja su cmstesting domain, gali sąveikauti su aukštos pridėtinės vertės ekosistemu. Mūsų programos siūlo struktūrizuotą būdą veikti kriptovaliutų rinkoje, apjungiant pažangią duomenų analizę, automatizuotą vykdymą ir tiesiogines duomenis. Vartotojai gauna prieigą prie išteklių, kurie padeda stebėti rinkos tendencijas ir tobulinti savo strategijas.

Momentiniai pranešimai didina rinkos sąmoningumą. cmstesting domain siūlo nedelsiantinį rinkos stebėjimą, kuris apima greitus pranešimus apie kainų svyravimus ir besiformuojančias tendencijas. Dirbantys su dirbtinio intelekto pagrindu analitikos išlaiko metodikas atitinkamomis dabartinėmis sąlygomis, leisdami vartotojams pasinaudoti kylančiomis galimybėmis.

Stocks Synergy Ai’s behavioural engine aligns live data with each trader’s preferred horizon, sector focus, and risk appetite. Neural pipelines analyse order-flow clusters, macro surprises, and sentiment drifts, then translate findings into succinct guidance that fits personal targets rather than one-size-fits-all averages. The outcome is perspective sharpened by context, not cluttered by noise.

Clear modules, tip overlays, and colour-coded panes let novices explore sophisticated metrics in just a few clicks. While seasoned participants fine-tune dashboards to suit custom checklists, Stocks Synergy Ai preserves an uncluttered workspace that keeps attention on strategy, not interface gymnastics.

Predictive models patrol volume spikes, liquidity vacuums, and crowd-mood reversals around the clock, flagging pivotal motion long before conventional screens react. When thresholds ignite, Stocks Synergy Ai dispatches device-agnostic notifications in real time, granting traders room to adjust size, timing, and contingency levels ahead of the herd.

Dedicated processors scan company releases, policy statements, and liquidity changes without pause, highlighting fresh catalysts seconds after they appear. Instant pop-ups and colour cues show probability ranges and likely time frames, so preparation can replace haste when conditions shift. Consistency in delivery keeps confidence steady through both calm and storm.

Institutional heat-maps, dynamic risk calculators, and blueprint libraries sit behind secure APIs and layered encryption, yet appear through streamlined toggles familiar to everyday users. By merging robust statistical engines with human-centred design, Stocks Synergy Ai maintains depth while eliminating bloat. Continuous diagnostics uphold system reliability, and restricted enrollment protects bandwidth so every registrant enjoys uninterrupted access to Stocks Synergy Ai’s live intelligence.

Pattern-recognition layers combine with curated playbooks to surface strategy archetypes tested by experienced analysts. Side-by-side comparisons reveal where momentum, liquidity, and sentiment converge, enabling newcomers and veterans alike to evaluate methods at a pace that suits their own decision style - without ceding execution control.

Integrity remains central: multi-factor entry gates, end-to-end encryption, and immutable audit trails shield personal data while transparent reporting removes hidden processes. By focusing solely on insight generation and never handling trades, Stocks Synergy Ai maintains a conflict-free environment built on verifiable trust.

Machine-learning layers inside Stocks Synergy Ai detect early inflection points, then match each signal with sample playbooks and back-testing widgets, letting traders gauge new tactics side by side and fine-tune positions as confidence builds.

Momentum fans often chase quick rotations, while macro observers ride broader waves. The analytics engine in Stocks Synergy Ai scores both styles for volatility burden, capital stretch, and psychological demand, helping every user align duration with comfort level and prevailing outlook.

Pre-set triggers encourage methodical action. Leveraging adaptive thresholds, Stocks Synergy Ai surfaces potential support, resistance, and sentiment pivots, displaying clear review zones that promote disciplined, emotion-aware engagement at every step.

Depth on the order book shapes spreads, timing, and execution risk. Stocks Synergy Ai continuously tracks sector-by-sector flow, flagging deep corridors and thin pockets so traders can size positions wisely, plot exit lanes, and hedge portfolios with greater accuracy.

Neural processors sweep order-flow surges, policy headlines, and crowd sentiment in milliseconds, then condense the turbulence into plain-language context. Anchored by live, data-driven observations, Stocks Synergy Ai nurtures measured timing, balanced stance, and flexible updates - keeping execution choices firmly under user control.

Stabilumo palaikymo atžvilgiu stabilizuoto kriptovaliutų susidomėjimo ir pripažinimo augimas didina prekybininkų smalsumą. cmstesting domain skatina ir stengiasi padėti vartotojams ištirti stabilias kriptovaliutas, kuriomis galima prekiauti šioje platformoje.

Turėdami įvairų stabilizacijos kriptovaliutų asortimentą, prekybininkai gali išbandyti įvairių kriptovaliutų galimybes, skirtas stabilumui išlaikyti. cmstesting domain siūlo patogesnę prekybos patirtį nepastovioje kriptovaliutų rinkoje. Kriptovaliutų prekybos ir analizės platformos įsipareigojimas teikti plačų stabilizuotų kriptovaliutų pasirinkimą skatina daugiau įtrauktis ir dinamiškumą kriptovaliutų rinkoje. Tai leidžia cmstesting domain galimai tenkinti prekybininkus, siekiančius stabilumo savo portfeliuose.

Kita vertus, kai reguliuotojai kuria naujas politikas, rinka gali tapti nestabili. Prekybininkai gali būti žingsniu prieš svarbius makroekonominius įvykius, naudodami duomenų apdorojimą, paremtą dirbtiniu intelektu. cmstesting domain suteikia naudingos informacijos apie galimus rinkos reakcijos požymius, analizuodama, kaip ekonominiai rodikliai veikė praeityje.

Suprasdami tokius išorinius veiksnius, prekybininkai gali prisitaikyti savo metodus, kad jie atitiktų juos, ir tada priimti išmintingus sprendimus. Apskaičiuodami pokyčius ekonomikoje rizikos valdymas ir prekyba tampa efektyvesniu. cmstesting domain padaro sudėtingas makroekonomines tendencijas lengviau suprantamas ir parodo, kaip pasaulio įvykiai veikia skaitmenines valiutas.

Blending these mood readings with structural indicators produces balanced, context-aware prompts that point toward preparation - not prediction. Execution remains the user’s decision, and no outcome is guaranteed. Limited registration slots safeguard server capacity, meaning the earlier a profile is secured, the sooner uninterrupted access to this evolving intelligence becomes part of every trading session.

Investicijų skleidimas tarp skirtingų turtų sumažina riziką. cmstesting domain naudoja žinomus algoritmus, kad analizuotų turtus ir siūlytų būdų diversifikuoti pagal tai, kaip elgiasi rinka. Sveikai subalansuotas portfelis gali sumažinti nestabilumo poveikį ir užtikrinti ilgalaikį stabilumą. Naudodamiesi tinkama turtų mišiniu, vartotojai gali kontroliuoti riziką ir padaryti savo portfelius atsparesnius.

cmstesting domain, sutuokdamas automatiką su profesionaliais žiniomis, daro prekybinės metodus tinkamus neprognozuojamai kriptografijos scenai. Ši sinergija palengvina prisitaikymą prie rinkos pokyčių, išlaikant prekybos procesą struktūrizuotą ir gerai informuotą.

High-frequency detectors inside Stocks Synergy Ai sweep liquidity ripples and order-flow bursts, issuing immediate prompts that help refine entry and exit markers while preserving data confidentiality through secure channels.

Momentum grids powered by Stocks Synergy Ai monitor sustained volume shifts and sentiment alignment, translating early signals into concise risk-reward dashboards so preparation consistently outpaces reaction.

Comprehensive turbulence mapping from Stocks Synergy Ai distinguishes fleeting spikes from wider trend shifts; registering now guarantees front-row access to these visual dashboards before capacity restrictions resume, offering valuable clarity when market conditions grow unpredictable.

Through responsive modelling paired with trader-controlled settings, Stocks Synergy Ai adapts information streams the moment conditions pivot. Volatility markers, liquidity cues, and rotation signals surface instantly, while every allocation or timing call remains the sole responsibility of the individual. The outcome is a nimble, data-grounded compass keeping critical market shifts visible without overriding personal strategy.

Stocks Synergy Ai pulls live pricing feeds, macro announcements, and sentiment readings from vetted channels, then filters them through adaptive AI models to present concise, real-time insight aligned with each user objective.

Alert settings inside Stocks Synergy Ai allow users to schedule threshold-based reminders that surface when risk bands shift or fresh opportunities appear, making periodic reviews smoother and less time-consuming.

Design choices in Stocks Synergy Ai combine clean layouts, drag-and-drop widgets, and guided prompts, ensuring advanced analytics feel approachable to first-time investors while still offering seasoned traders deep customisation.